Managing Liquidity Pools in Uniswap V3 — Cryptum’s quick introduction

In the spirit of curiosity and enlightening the public about DeFi, our Tech Lead Vitor Rezende Costa, wanted to share some insights from his experience working with LP on Uniswap V3. This journey involves a touch of economics, a pinch of strategy, and a whole lot of Uniswap V3.

Discover in this article how worthwhile is it to leverage your crypto assets into Uniswap.

Comparing Our Liquidity Provision vs. Other Strategies

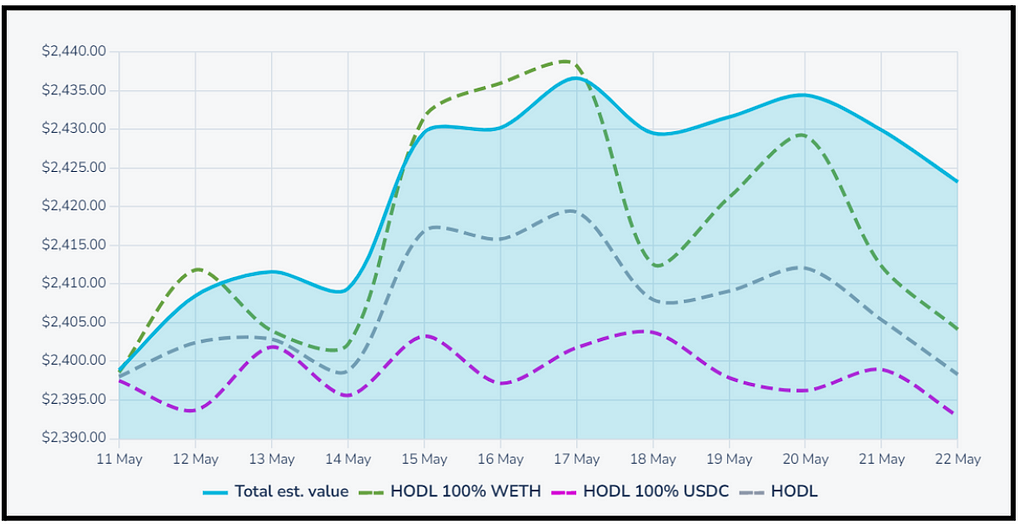

When providing liquidity, there is a set of parameters you can configure and strategies you can adopt. Our adventure began by evaluating four distinctive strategies: 1- Implementing our own approach (blue); 2 — Holding 100% of WETH (green); 3 — Holding a balanced 50/50 portfolio of WETH and USDC (grey); 4 — Holding 100% of USDC. The graph below provides a comparative analysis of these strategies over a period of roughly 10 days:

The final results, after 10 days, were:

1 — Our strategy: $2,422.32 (⬆️1.31%)

2 — Hold WETH: $2,404.14 (⬆️0.56%)

3 — Hold 50/50: $2,398.30 (⬆️0.32%)

4 — Hold USDC: $2,392 (⬆️0.1%)

Breaking Down the Profits — Asset Appreciation vs Liquidity Provisioning Fee

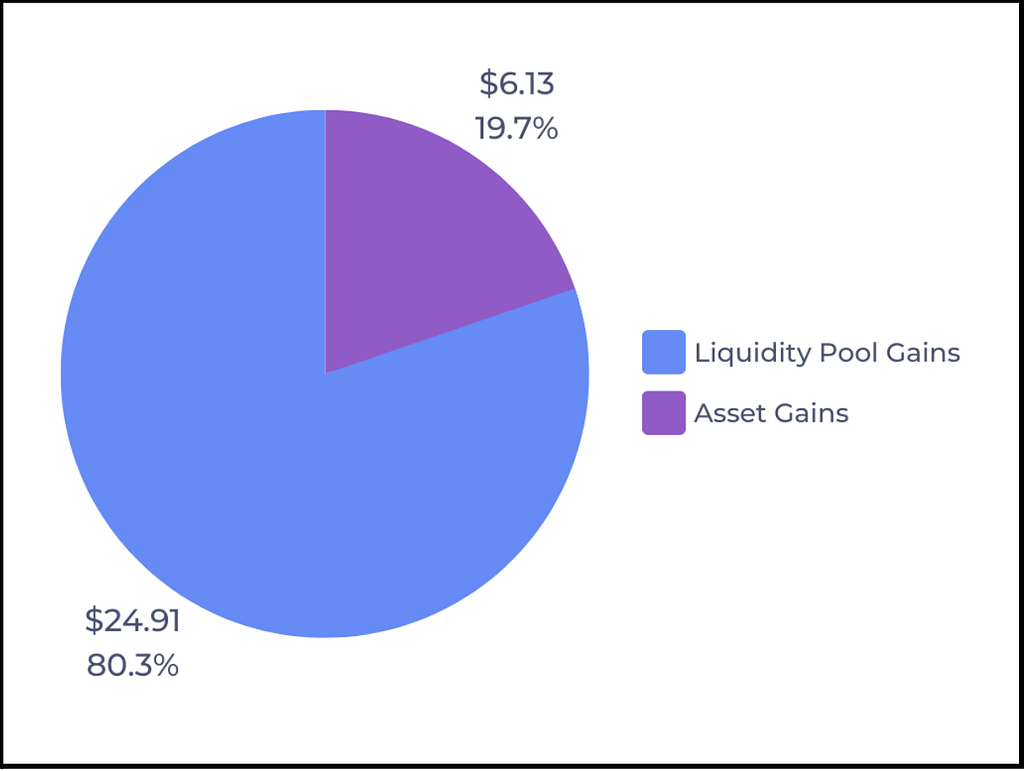

An initial capital worth $2,391.98 was provided, and $0.89 were spent on transaction fees, meaning we got exactly $31.23 as profit. As expected, our approach significantly outperformed the others, and this can be clearly explained when we take a look to inspect where the profits came from:

Fees accrued from liquidity provision are almost four times higher than the natural asset appreciation. This serves as a reminder that while asset gains are important, the role of liquidity provision shouldn’t be understated. The true essence of DeFi’s profitability often lies in its diverse income streams.

What About Impermanence Loss?

Impermanence loss has been an inherent risk in the DeFi world. However, by leveraging Uniswap V3’s concentrated liquidity feature, we managed to reduce the impermanence loss significantly.

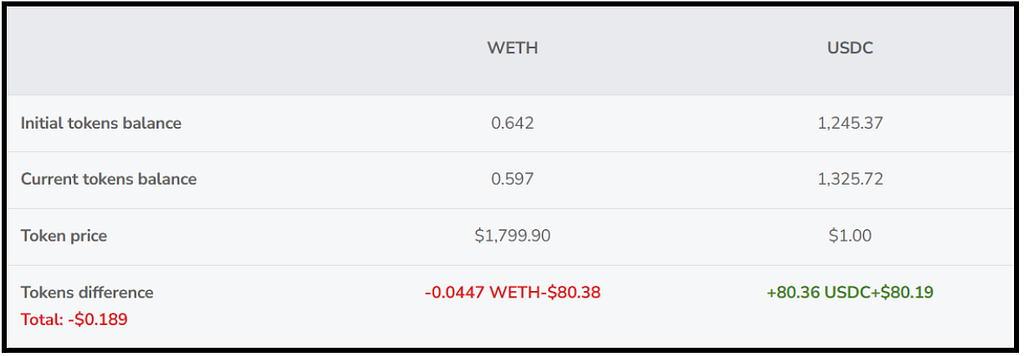

Impermanence loss is easier to understand than people think: when you provide liquidity, you might end up with a different ratio of tokens than when you got in. Due to some math reasons, the initial token ratio appreciation would always have been higher than the current asset gains. The difference between this hypothetical appreciation in case you held the original ratio and the appreciation that you actually experienced is called impermanence loss.

In the image above, you can see that the ratio shifted: We “got” more USDC than when it started and “lost” some WETH in the process. Precisely $80.38 less of WETH, and $80.19 more of USDC. This difference in value is the total impermanence loss: $0.189. This concept can be scary because it’s literally impossible to escape this phenomenon, but it can be greatly mitigated — after all, we got a ⬆️1.04% profit from liquidity provision fees and a whopping ⬇️0.01% impermanence loss from liquidity provision.

Note:

This was just a quick study, not financial advice. Investment in DeFi should be undertaken only with a thorough understanding of the protocols.

Stay connected to us on our socials for more deep dive into DeFi ecosystem and its applications!